If in case you have not had an analysis of your enterprise’ value on as a minimum three stages over the path of the last twelve months, you should don’t forget it. A business valuation presents the trade owner with multiple details and figures involving the precise worth or value of the enterprise in phrases of market competitors, asset values, and sales values.

This expertise is something that each one industry owners should have to be had. Acquiring an industry valuation must also be completed each year to show manufacturer progress.

What is a Business Valuation?

An industry valuation is, to put it into generally applicable terms such as the definition, “the process of deciding on the economic worth of a business or organization.”

Why You Need a Business Valuation?

Quick question, if you had to sell your business tomorrow, do you know how much it’s actually worth?

If you have never had a formal or informal valuation done by a professional, you could end up leaving a lot of money on the table when you sell your company. Worse yet, you might pocket a number for your business that is far lower than you anticipated and find yourself scrambling to downsize your lifestyle in retirement.

This is why having a valuation done by an independent professional may be the most important thing you do when planning to exit your business.

Quick question, should you needed to promote your corporation the next day, have you learnt how a lot it’s truly worth?

When you have certainly not had a proper or informal valuation finished by means of a respectable, you might grow to be leaving some huge cash on the desk while you promote your organization. Worse but, you would pocket a number for your business that’s a ways lessen than you predicted and in finding yourself scrambling to downsize your lifestyle in retirement.

This is the reason having a valuation completed by using an unbiased authentic could also be the fundamental thing you do when planning to exit your enterprise.

Overpricing

what you are promoting can also be bad in view that it chases away advantage investors and different patrons who may have in any other case bought your online business if the purchase cost used to be extra in keeping with the market.

Under pricing your business can be just as terrible because experienced investors know a great deal when they see one, and will not hesitate to snap up a business that is selling for significantly less than its actual value.

One foremost thing to preserve in mind when you participate in a business valuation is that the worth you calculate typically gainer’s be equal to the rate customers will likely be inclined to pay. Now not shocking, customers assume to pay a price that’s low sufficient to show a revenue someday in the following couple of years.

Here are some benefits of getting a business valuation:

Knowledge of Company Assets

It is considerably important to obtain an accurate business valuation assessment. Estimates are not tolerable as it is a generalization.

Specific numbers need to be gained from valuation processes so that business owners can obtain suitable insurance coverage, know how much to reinvest into the company, and how much to trade your company for so that you can still make a profit.

Understand Company Resale Value

If you are contemplating selling your company, knowing its accurate value is necessary. This method should be started far before the business goes up for sale on the open market because you will have an opportunity to take more time to increase the company’s value to attain a higher selling price. As a business holder, you should know what your company’s valuation is.

You also need to be alert of what your company’s resale value really is in order to negotiate a higher selling price. Use black and white statistics, provided by a valuation firm, to freeze your stance on the higher selling price.

To Obtain a True Company Value

Knowing the proper value of your company is often a deciding factor if selling the business becomes a possibility. Potential buyers like to see that a company has seen accepted, consistent growth as it ages.

But, there is much more to business valuations than these undemanding factors as stock market value, total asset value and company bank account balances

Better During Acquisitions

If a major company asks about purchasing your company, you have to be able to show them what the value is as a whole, what its quality with holdings are, how it has grown, and how it can maintain to grow. Major corporations will attempt to get a hold of your business or merge with it for as little money as possible.

Access to More Investors

When you seek additional investors to fund company growth or save it from fiscal disaster, the investor is going to want to see a complete company valuation report. You should also provide probable investors with a valuation projection based upon their provided funding.

Conclusion

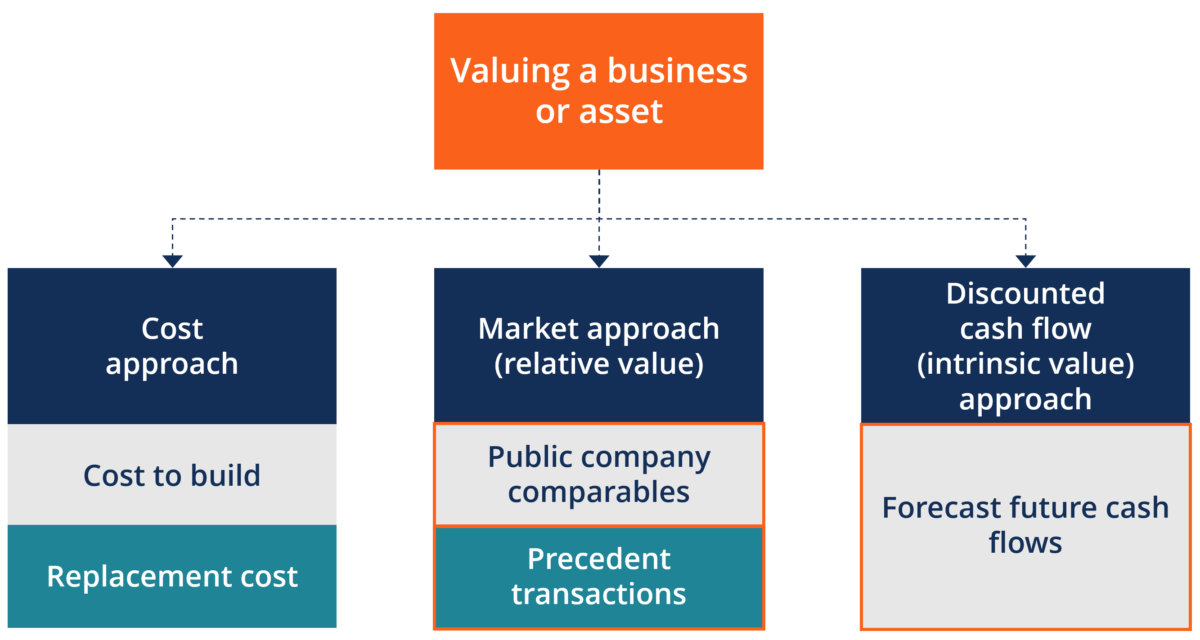

Once your business’ valuation has been recognized, set new goals to increase the company’s value over the next year. Every year, you should set time aside to compare the previous years’ valuations to determine growth, losses, and notice where room for improvement is. There are three major types of valuations, and companies should take advantage of the opportunity to complete all three annually.

Knowing what every component of your business is worth is priceless information for business owners to have.